Drop #63: Eigen Layer

Building a restaking collective for Ethereum

Announcement 📢

Starting a curated, fortnightly dealflow of exciting, upcoming projects - sounds interesting? Simply reply to this to subscribe

Today we are talking about 👇

Eigen Layer

What is Eigen Layer all about?

Eigen Layer is building out a re-staking primitive that allows users to re-stake their already staked ETH helping improve the security & validation services.

Stakers grant Eigen Layer smart contracts permissions to impose additional slashing conditions (if they fail to comply / default) in return for some incentives / rewards to restake their staked ETH.

It supports scalable infrastructure, empowering individual and large-scale stakers to drive decentralized blockchain innovation.

Problems with the current ecosystem

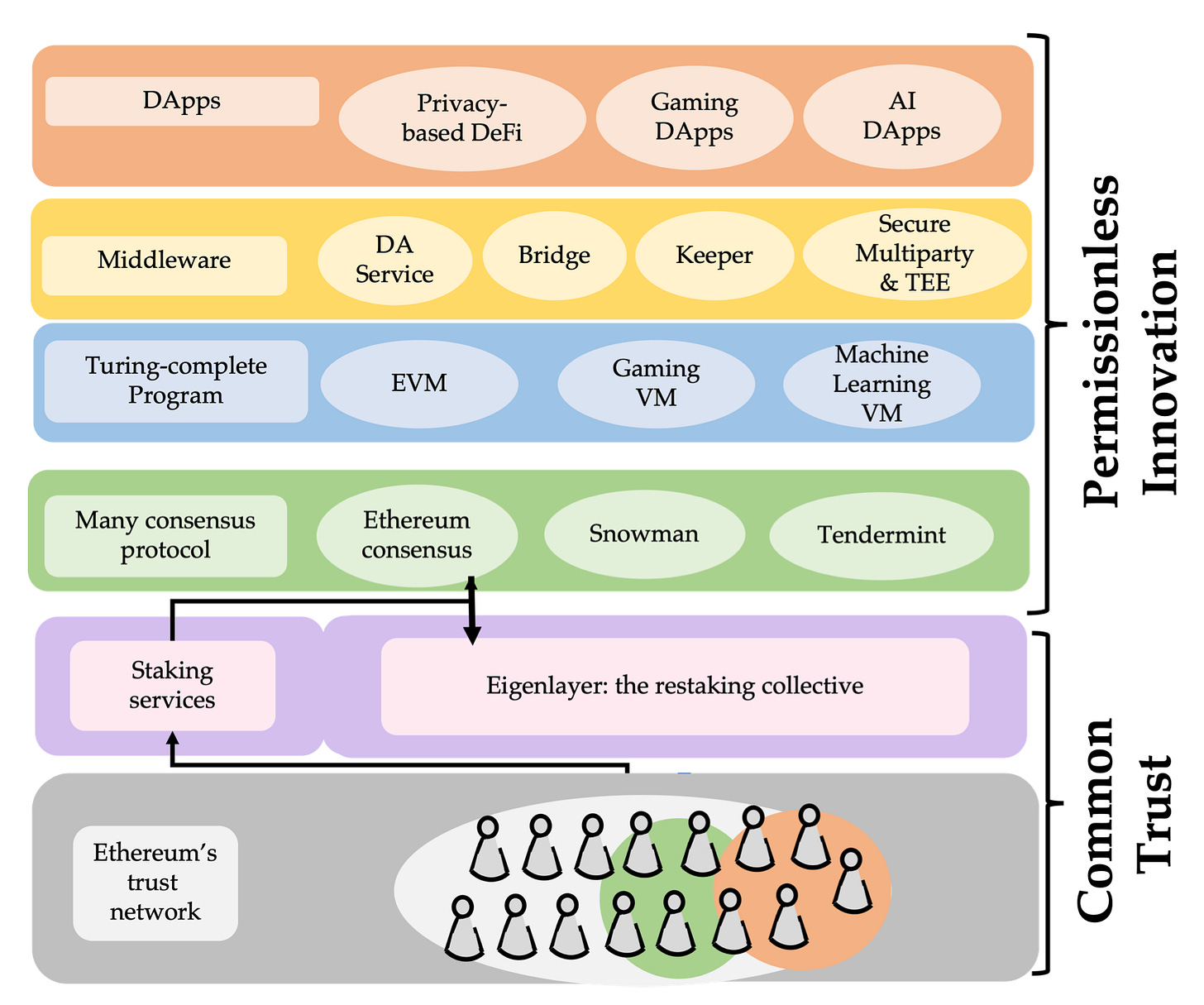

In the current blockchain ecosystem, the organization and deployment of actively validated services (AVS), which are critical for decentralized application (DApp) operations, pose significant challenges.

These services, like sidechains based on new consensus protocols, data availability layers, and oracle networks, often cannot be deployed or verified within the EVM, and therefore, are unable to benefit from Ethereum's pooled trust.

This gives rise to various hurdles such as

trust network bootstrapping

value leakage

excessive capital costs

lower trust model for DApps

How Eigen Layer solves it?

EigenLayer addresses the current ecosystem's challenges by allowing Ethereum stakers to opt into validating new software modules, thereby extending cryptoeconomic security.

It aggregates ETH security across modules, enhancing DApp security and offering additional fee-generation opportunities.

It also encourages permissionless innovation by allowing innovators to utilize the existing security and decentralization provided by Ethereum stakers, eliminating the need to build separate trust networks.

For this, they are introducing 2 novel ideas - which we’ll discuss below.

The two novel ideas

The two ideas proposed are:

Pooled Security via restaking : serving to extend the security of Ethereum to any system

Free-market Governance: to eliminate the inefficiencies of existing rigid governance structures

Let’s learn about each of them more 👇

→ Pooled Security:

EigenLayer introduces "restaking" to boost security across various applications.

Ethereum validators opt into new modules built on EigenLayer by setting their beacon chain withdrawal credentials to the EigenLayer smart contracts.

These modules can then impose additional slashing conditions on the validators' staked ETH, thus ensuring a higher level of security.

Validators are rewarded with extra income for providing this added security.

Restaking expands the range of secure applications, fostering innovation beyond traditional smart contract-based DApps.

→ Free-market Governance

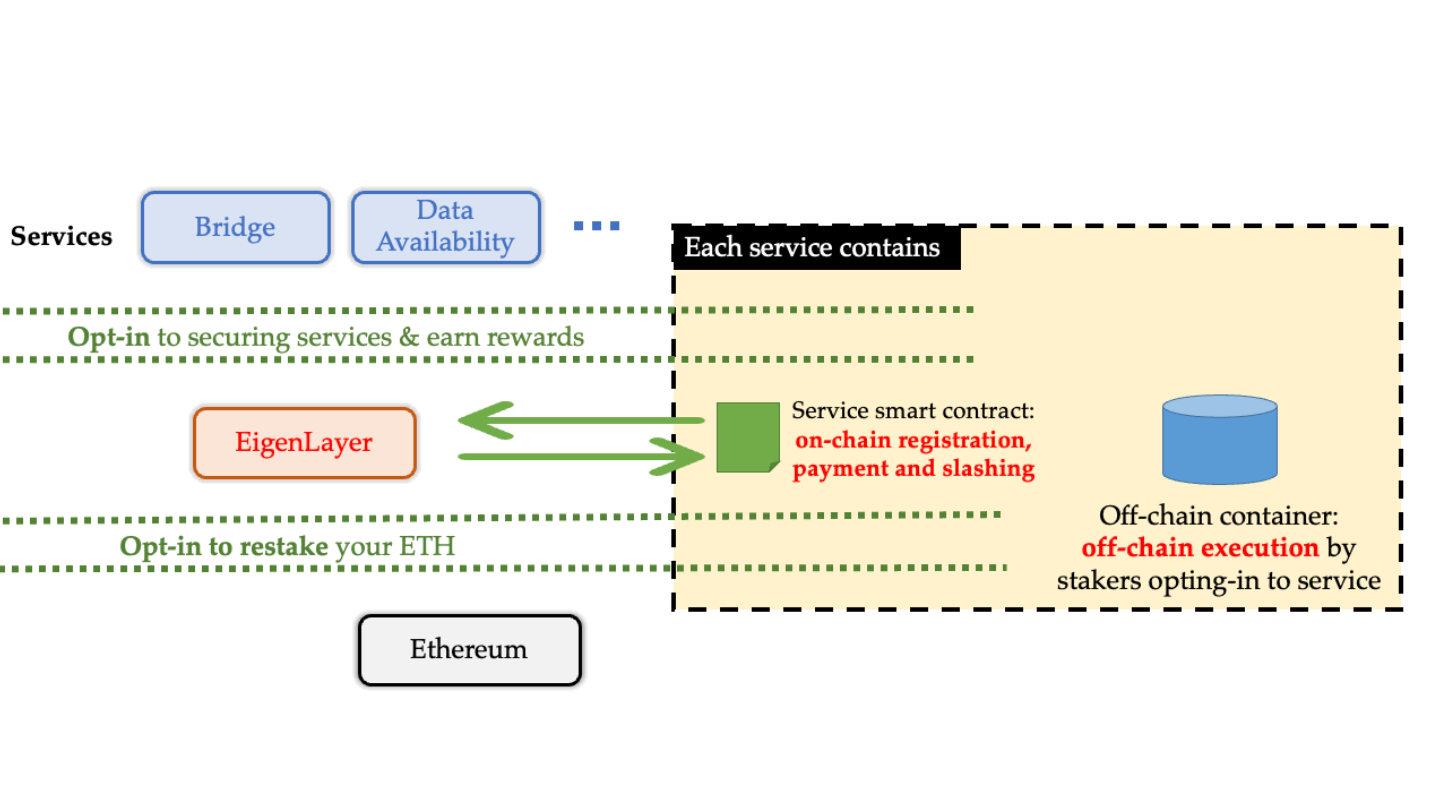

EigenLayer functions as an open market, balancing the security needs of various applications and the supply provided by validators.

Validators can opt-in or out of securing different modules, leading to a dynamic marketplace.

This system encourages rapid, market-driven governance for launching new capabilities.

Core Features & Benefits

So, with the help of these 2 novel ideas, what’s are the core benefits / use-cases that can be solved easily?

The core features are:

Quick Setup for New Services: EigenLayer allows a new AVS to quickly gain security from Ethereum's extensive validator set.

Reduced Capital Cost: By reusing their ETH stake across various services, validators' capital cost gets spread out, effectively lowering it.

Enhanced Trust: By pooling a larger capital stake, EigenLayer significantly strengthens the overall trust model.

Multiple Revenue Streams: EigenLayer provides Ethereum stakers with additional income opportunities, further solidifying the network's collective benefits.

Let’s understand that with an working flow 👇

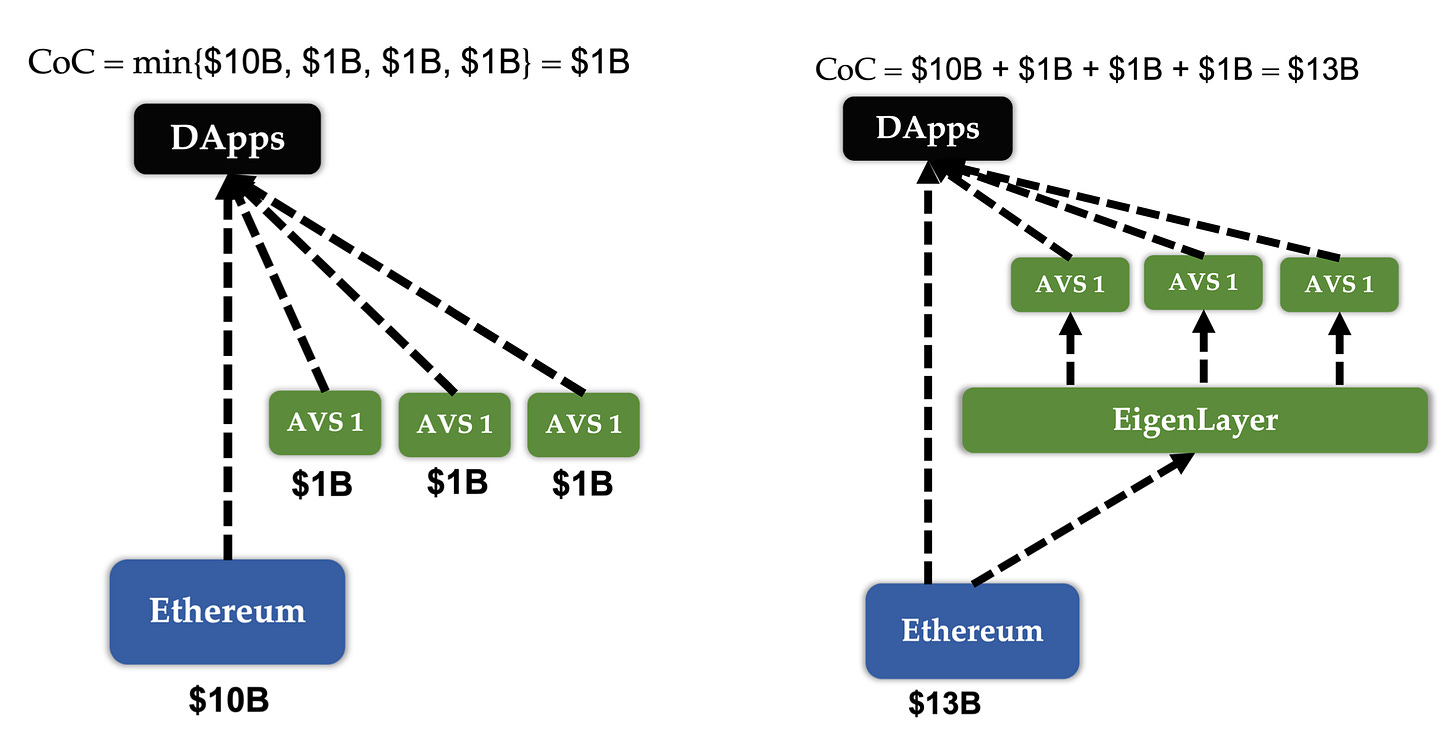

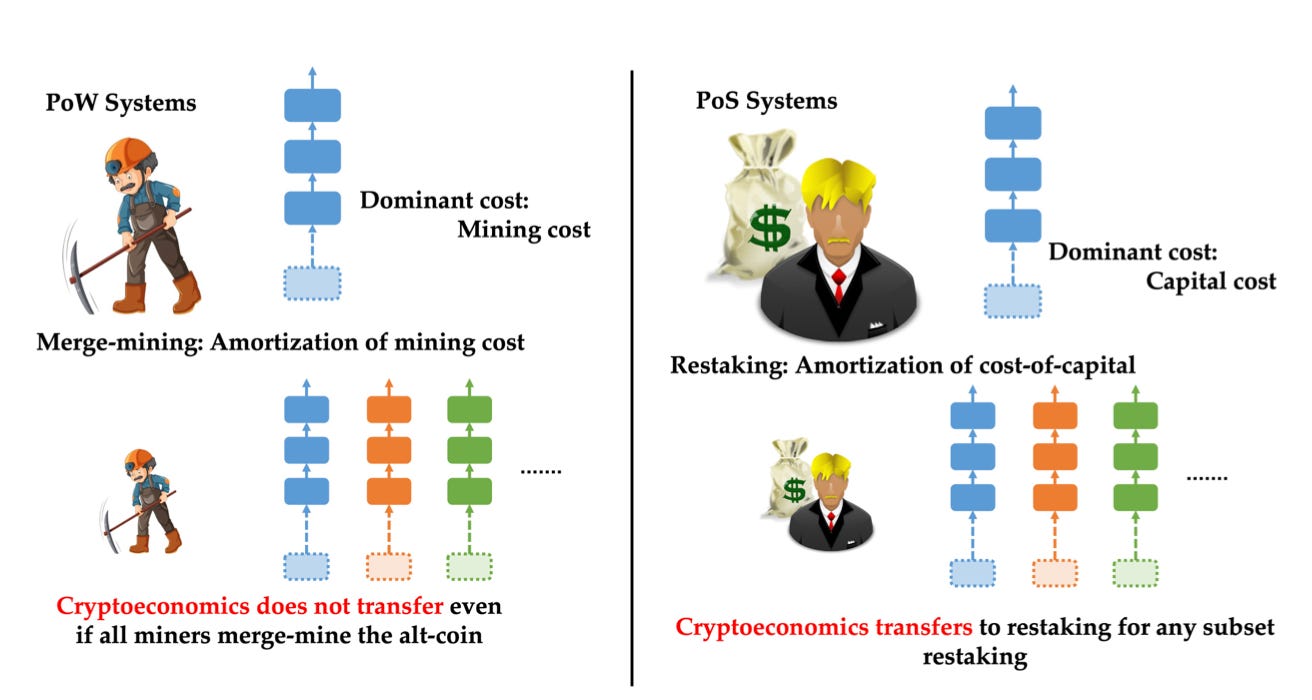

EigenLayer's pooled security approach significantly raises the cost of corruption.

Instead of merely needing to attack a single module secured by a $1B stake, an attacker now faces the much greater hurdle of needing to compromise the entire pooled stake of $13B.

This effectively makes the system more resilient to attacks.

Different staking solutions

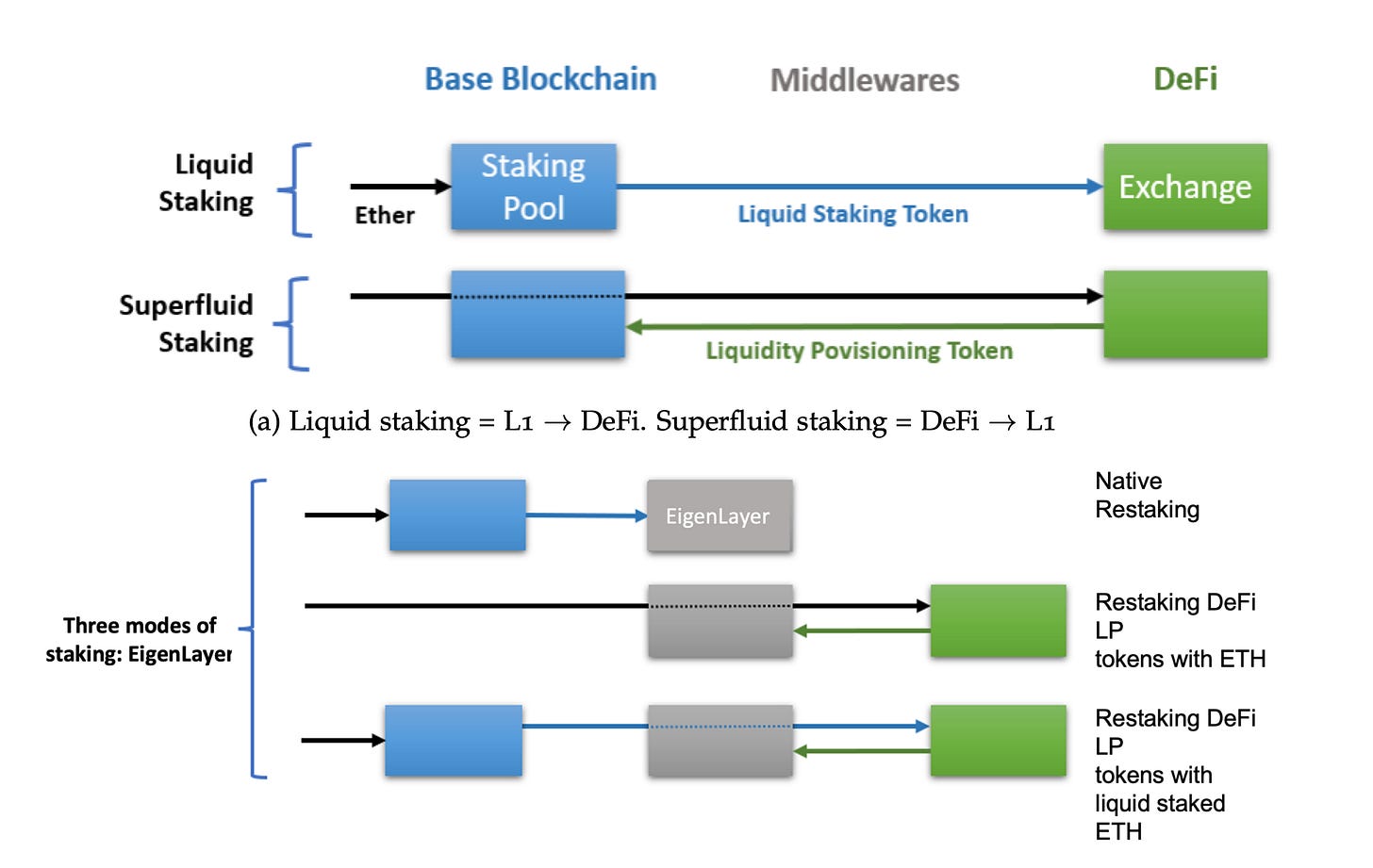

EigenLayer offers a variety of yield stacking, allowing stakers to earn additional income by securing new AVSs.

It establishes an efficient interaction between the core blockchain protocol, AVS, and DeFi, enabling various modalities of restaking.

A few of the restaking schemes are:

Native restaking: Validators can directly restake their ETH by linking their withdrawal credentials to EigenLayer's contracts, essentially stacking yield from L1 to EigenLayer.

LST restaking: Validators can restake their LSTs (ETH already restaked via protocols like Lido and Rocket Pool) by transferring their LSDs to EigenLayer contracts, enabling DeFi to EigenLayer yield stacking.

ETH LP restaking: Validators stake the LP token of a pair that includes ETH, offering a path from DeFi to EigenLayer for yield stacking.

LST LP restaking: Validators stake the LP token of a pair that includes a liquid staking ETH token (like Curve’s stETH-ETH LP token), allowing a path from L1 to DeFi to EigenLayer for yield stacking.

This is how actually the flow of of the staking for different methods of staking.

Each of the methods have their own pros & cons - and depending on the need & use-case the relevant ones can be chosen.

Delegation & Governance

EigenLayer allows restakers holding ETH or LSTs to delegate their stake to other entities running EigenLayer operator nodes, facilitating an open market for delegation and providing avenues for additional revenue.

The different types of stakings are as follows:

Solo Staking

Solo stakers have the option to directly participate in EigenLayer by opting into AVSs.

They can also delegate EigenLayer operations to another entity while continuing to validate Ethereum themselves,

Delegation Model

Restakers delegate their stake to an operator.

If the operator fails in its duties within EigenLayer modules, both the operator's and the restaker's stake is subject to slashing

This emphasizes the need for delegating only to trusted, reliable operators.

Fee Model:

Restakers should also consider the ratio of fees shared back by operators.

This establishes a competitive free market for delegation

Operators set up contracts that specify how fees are divided and routed back to delegators.

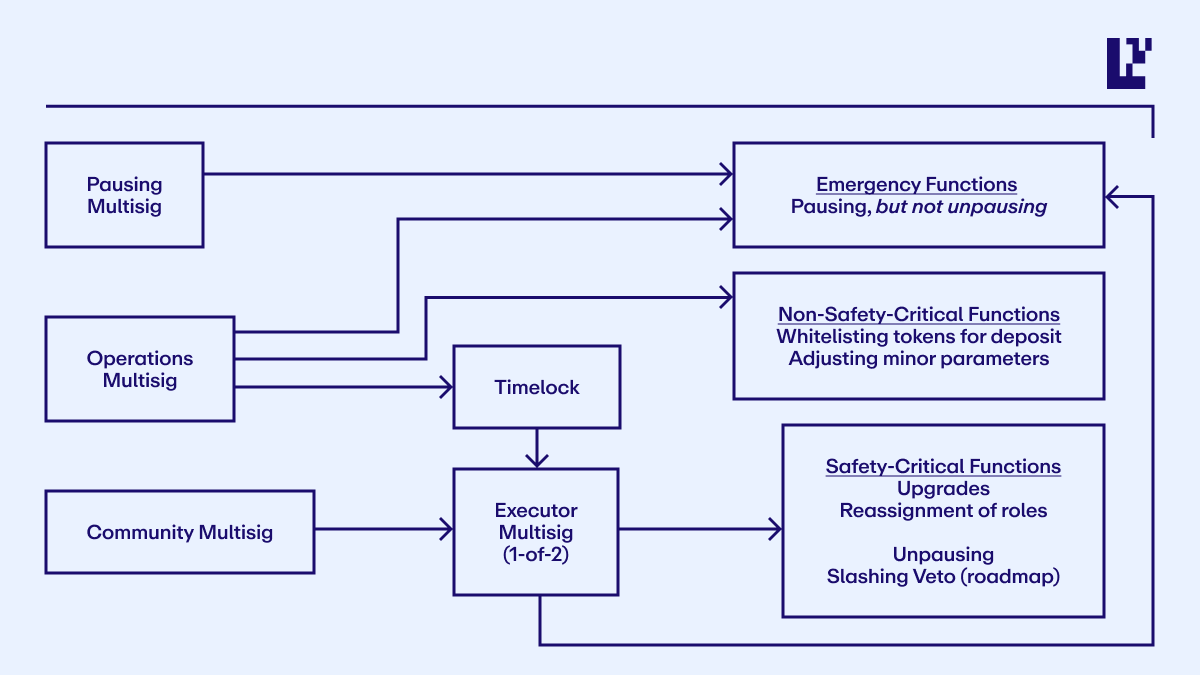

On the governance front, EigenLayer employs a reputation-based committee for governance, comprising reputed members of the Ethereum and EigenLayer community. They manage upgrades, review slashing events, and approve new AVSs.

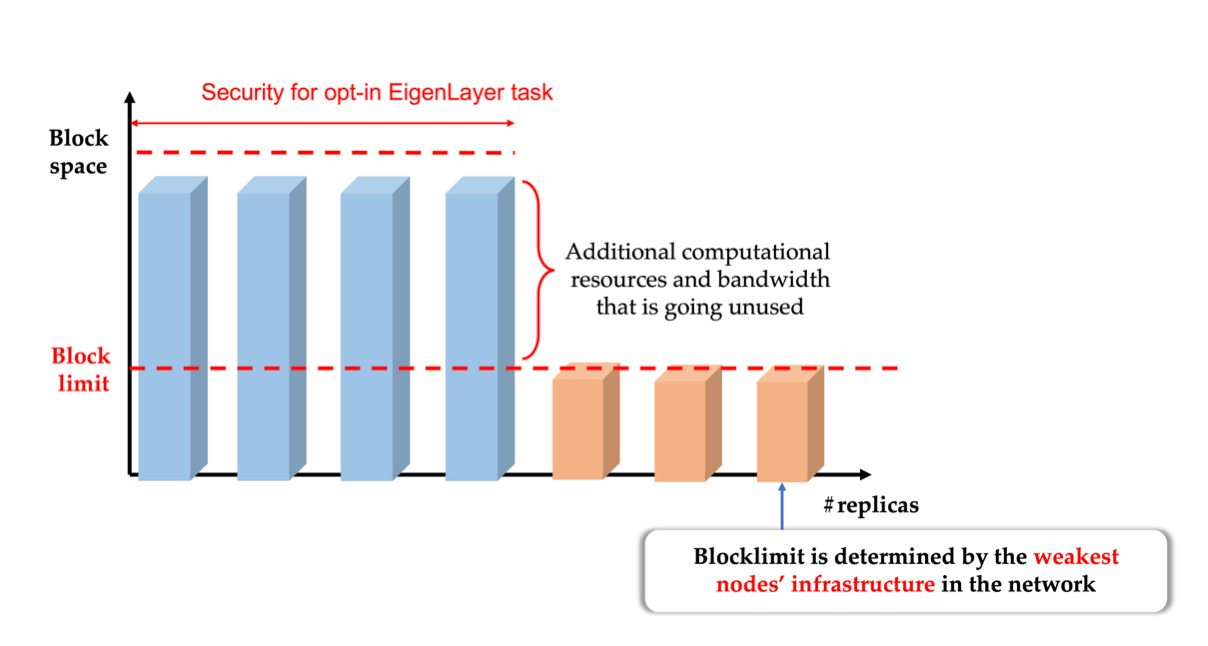

Minimizing Centralization Pressures

EigenLayer's design prioritizes both security and minimal centralization by ensuring that all restaked ETH is utilized for securing AVSs.

However, it balances this with the operational costs and resource constraints of the operators. To address this, EigenLayer proposes two types of AVS design:

Hyperscale AVS

This involves dividing the computational workload across all participating nodes, a process called horizontal scaling.

It not only enables high throughput but also discourages centralized validation due to the varying validation requirements for each key.

Lightweight AVS

This includes tasks performed redundantly by all operators that are low cost and require minimal computing infrastructure.

Tasks include verifying zero-knowledge proofs, running light nodes of other blockchains and so on.

The combination of these design patterns aims to optimize the yield from EigenLayer, benefitting even home validators in Ethereum and reducing centralization pressures.

Slashing Overview & Risk Mitigation

EigenLayer uses a slashing mechanism to ensure cryptoeconomic security in Ethereum Proof-of-Stake (PoS) staking.

Misbehaving stakers are penalized by freezing their ETH, preventing further participation.

Unlike other platforms, EigenLayer avoids issuing a fungible token for restaked positions to maintain transparency.

It differs from concepts like merge mining as restaking strengthens security rather than posing vulnerabilities.

EigenLayer's restaking enhances security, unlike merge mining which can introduce vulnerabilities.

Operator Collusion: EigenLayer uses a cryptoeconomic dashboard to monitor operator activity and prevent overextension, ensuring 'elastic security'.

Unintended Slashing: Managed through security audits and a governance layer's ability to veto slashing events, protecting against potential vulnerabilities in new AVSs.

Eigen Layer in action

EigenLayer enables a broad set of new AVS’s including new blockchains, middleware, and modular blockchain layers.

A few of the applications where Eigen Layer can make a great difference are:

Hyperscale Data Availability Layer

Utilizes EigenLayer's restaking to create a high-capacity Data Availability (DA) layer with low costs.

This leverages cutting-edge DA techniques from the Ethereum community.

Decentralized Sequencers

Rollups on EigenLayer can use decentralized sequencers for managing their own Maximum Extractable Value (MEV)

This provides censorship resistance, enhancing their overall security and integrity.

Fast-Mode Bridges for Rollups

Facilitates off-chain ZK proof verification for ZK rollups.

This boosts efficiency and reduces on-chain verification costs, enhancing the performance of ZK rollups.

Oracles

EigenLayer makes it possible to create reliable price feeds based on the majority trust of ETH restakers.

This offers a valuable resource for smart contracts needing reliable price information.

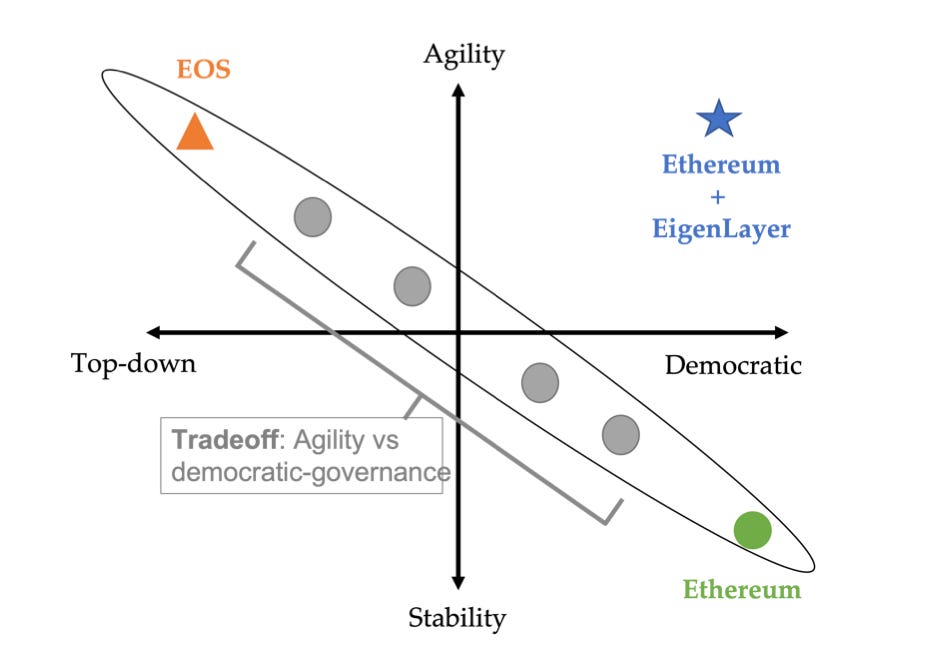

EigenLayer enhances Ethereum by fostering agile innovation without compromising the democratic governance and stability of the base layer.

It essentially acts as a staging network for Ethereum, supporting rapid, permissionless innovation, while maintaining long-term stability through Ethereum's robust upgrade process.

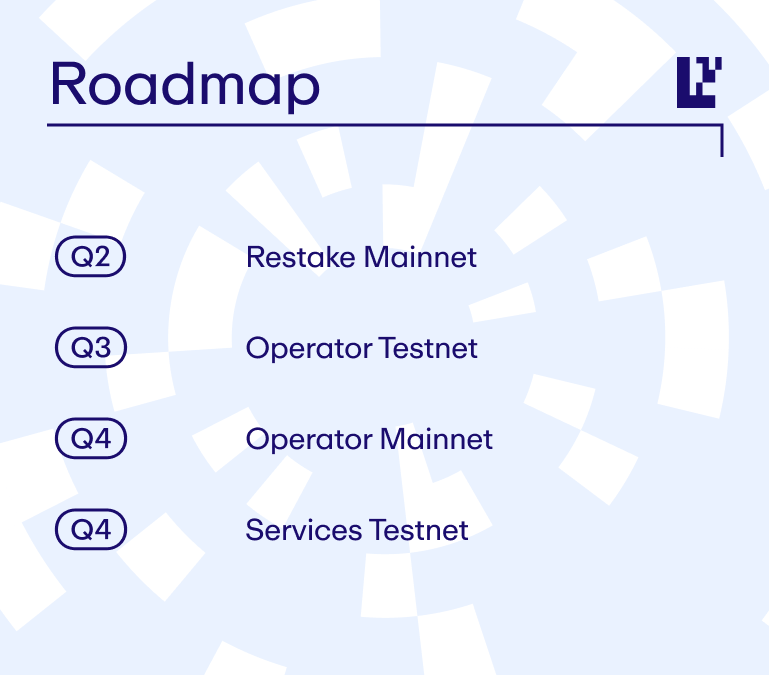

Roadmap

Team

Sreeram is the founder of Eigen Layer. He is an associate professor at the University of Washington and runs the UW Blockchain Lab.

The team has deep experience with tech companies, including AWS, Meta and Microsoft.

You can learn more about them here

Venture Funding & Support

Early in the year, they raised a whooping $50mn in their Series A round which was led by Blockchain Capital & saw participation from Coinbase Ventures, Polychain Capital, Electric Capital, Hack VC.

They also raised $14mn in their seed round last year.

Partnerships & Updates

They’re already working hard on getting stuff out. A few of them to check out are

EigenLayer Stage 1 Mainnet Launch: info

Increasing restaking capacity: info

Partnership with Espresso Systems to bring restaking to the Espresso Sequencer network: info

Partnership with Celo to support validation and promote fast finality via dual-staking: info

Partnership with Spice AI for indexing and back-end support for consensus and execution layer data: info

How to get involved?

Thank you for your time to read through the coverage for Eigen Layer. Hope you enjoyed it!

If you’d love to learn more about them:

Thank you once again!